Not known Incorrect Statements About Opening An Offshore Bank Account

Table of ContentsA Biased View of Opening An Offshore Bank AccountUnknown Facts About Opening An Offshore Bank AccountHow Opening An Offshore Bank Account can Save You Time, Stress, and Money.Opening An Offshore Bank Account Can Be Fun For AnyoneUnknown Facts About Opening An Offshore Bank AccountSome Of Opening An Offshore Bank Account

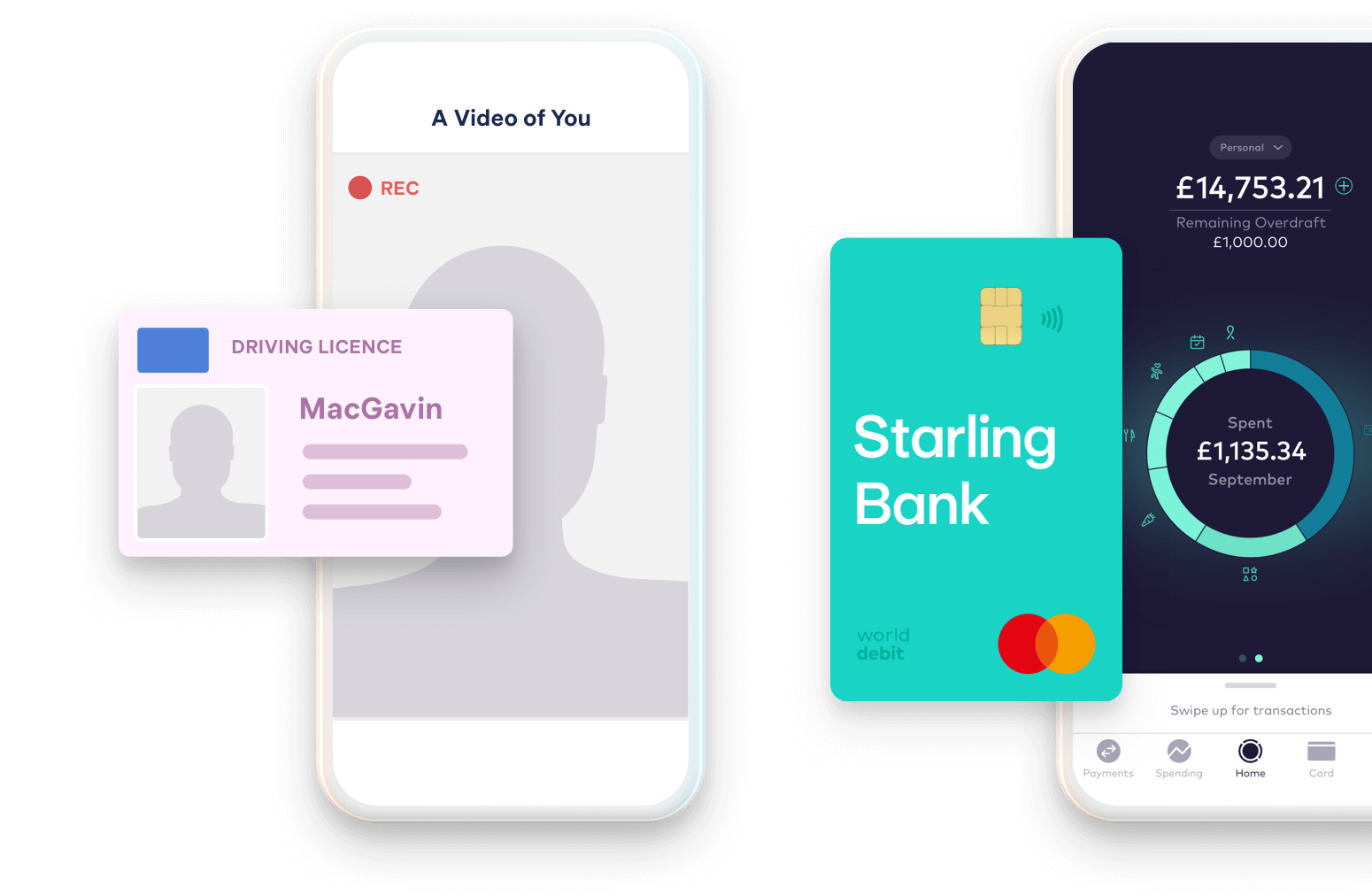

Whether you're thinking of moving to the UK or you have actually arrived there already, at some point you're mosting likely to require a bank account. In the past, opening up a checking account in the UK was very hard if you were brand-new to the country. Luckily, these days, it's become slightly much easier (opening an offshore bank account).As soon as you've changed your address, ask your bank to send out a financial institution declaration to your new address by post, as well as you'll have a paper that verifies your UK address. If you do not have an evidence of address in the UK and also you require to open an account, Wise's multi-currency account might be the ideal option for you.

Can I open a checking account before I get here in the UK? Yes, you can. Your house bank might have the ability to establish up a represent you if it has a contributor financial relationship with a British financial institution - opening an offshore bank account. Many significant UK banks also have supposed. These are designed specifically for non-residents, so they're a terrific option if you do not have the files to confirm your UK address.

Things about Opening An Offshore Bank Account

This can make your bank account expensive to open up and also run, especially if you still do not have a work. There may also be various other limitations. You may not be able to close the account as well as switch to a far better deal up until a collection duration of time runs out. The Wise multi-currency account.

Some financial institutions are strict with their needs, so opening up a checking account with them will be hard. What is the easiest checking account to open up in the UK? It's typically easier to open an account with one of the - Barclays, Lloyds, HSBC or Nat, West. These banks have stayed in business for a long period of time as well as are really safe.

The Best Guide To Opening An Offshore Bank Account

Barclays Barclays is one of the oldest financial institutions in the UK; and has more than 1500 branches around the nation. It's additionally most likely one of the simplest financial institutions to open up an account with if you're new to the UK.

The account view website is free and features a contactless visa debit card as standard. You will not be able to utilize your account promptly. When you're in the UK, you'll have to go to a branch with your referral number, ticket as well as proof of address in order to turn on the account.

Barclays also uses a few different company accounts, depending on the yearly turnover rate. You can connect with client assistance via a online chat, where you can review the details of your application and also ask concerns in genuine time. Lloyds Lloyds is the largest service provider of bank accounts in the UK, and also has about 1100 branches throughout the country.

What Does Opening An Offshore Bank Account Do?

You can speak to client support by means of a live chat, where you can review the details of your application as well as ask any kind of questions in real time. Various other banks worth exploring While Barclays, Lloyds, HSBC and Nat, West are the 4 greatest banks in the UK, there are also various other financial institutions you can check.

Of program, it's always best to look at what different banks have to offer and also see that has the finest offer. You can obtain a standard existing account at no regular monthly cost from many high road financial institutions.

The majority of banks additionally have exceptional accounts that provide extra advantages such as cashback on household expenses, in-credit rate of interest and also insurance coverage. These accounts will certainly often have monthly charges and also minimum qualification demands; as well as you may not qualify if you're brand-new to the UK. You'll likewise require to be careful to remain in credit history.

Not known Details About Opening An Offshore Bank Account

If you're not using one of your financial institution's ATMs, examine the device initially. Numerous atm machine equipments will specify that they are free. In a similar way, some paid devices will certainly caution you concerning costs before you can finish the purchase. Utilizing an Atm Machine outside you can look here the UK is never cost-free. Lots of banks will certainly charge a, which can be as high as 2.

When you open this account, you'll have the alternative to take out an. An organized overdraft allows you to obtain money (up to a concurred limit) if there's no cash left in your account.

3 Simple Techniques For Opening An Offshore Bank Account

We'll constantly attempt to permit crucial settlements if we can - opening an offshore bank account. You can apply for an arranged over-limit when you open your account, or at any time later. You can ask to raise, get rid of or minimize your limit at any type of time in online or mobile banking, by phone or in-branch.

We report account activity, consisting of overdraft account use, to credit history referral agencies. This account comes with a.